Bitcoin Spot Volume Surges Past $300 Billion in October, Onchain Data Reveals Market Health

On November 7, Cointelegraph, a prominent cryptocurrency news outlet, underscored the critical role of onchain data in understanding market dynamics, tweeting, "> Find out what onchain data really reveals." This call to action highlights the growing reliance on blockchain analytics to decipher complex market trends and investor behavior. Recent analyses by Cointelegraph, leveraging onchain metrics, have shed light on significant shifts within the Bitcoin market, including a substantial increase in spot trading volume.

Onchain data, which refers to publicly available information recorded on a blockchain, provides unparalleled transparency into transactions, wallet activity, and exchange flows. This granular insight allows analysts to move beyond price charts and gain a deeper understanding of underlying market sentiment and structural changes. By examining metrics such as transaction volumes, exchange balances, and funding rates, experts can identify key trends often invisible through traditional market indicators.

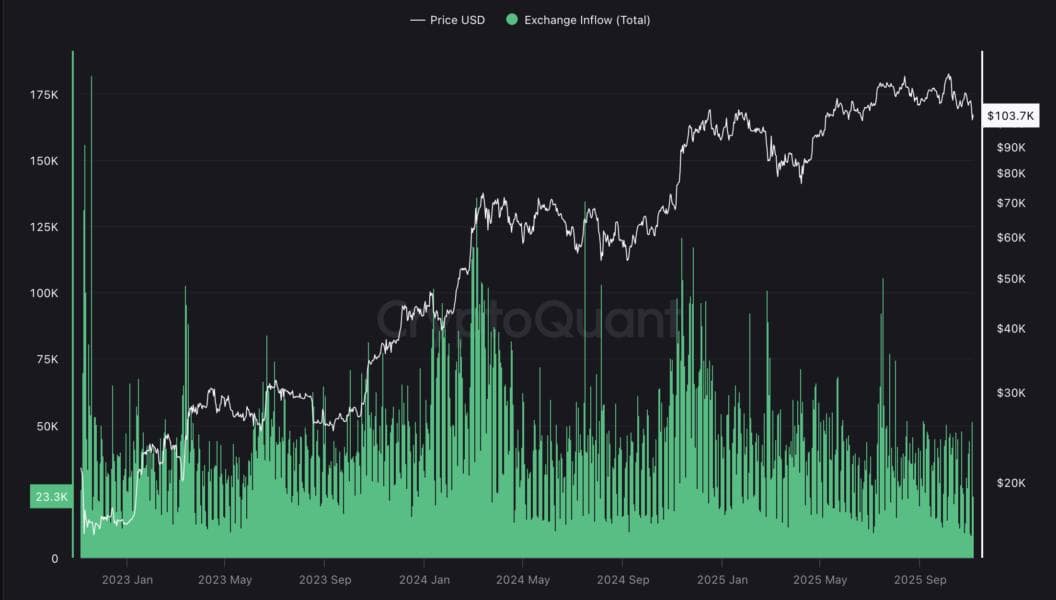

A recent report by Cointelegraph, citing onchain analytics platform CryptoQuant, revealed that Bitcoin spot market trading volume exceeded $300 billion in October 2025. This surge, particularly with Binance accounting for $174 billion, indicates a "healthy" pivot towards spot trading. CryptoQuant contributor Darkfost noted that this trend signifies increasing participation from both retail and institutional traders, making the market more resilient to short-term volatility compared to derivative-led markets.

While the $300 billion spot volume suggests market health, Cointelegraph also utilized onchain data to identify potential bearish signals. Another analysis, referencing Glassnode and Swissblock, indicated that Bitcoin might be transitioning into a bear market, with BTC falling to four-month lows of $98,900. Reduced bullish leverage, as shown by a 62% decline in monthly funding paid by longs in Bitcoin perpetuals, and a breakout in USDT dominance further support this outlook, signaling increased risk aversion among traders.

The insights drawn from onchain data offer crucial intelligence for investors navigating the volatile cryptocurrency landscape. Cointelegraph's consistent reporting emphasizes that these metrics provide a clearer picture of market structure and participant behavior. The shift towards spot-driven activity, alongside warnings of potential downtrends, underscores the multifaceted revelations that onchain analytics bring to the forefront of crypto market analysis.