Ethereum User Claims 75% App Capital Market Share in Blockchain Debate

A social media user, identified by the handle "⟠", recently asserted that the Ethereum network commands approximately $500 billion in "app capital," securing a dominant 75% market share among major blockchain platforms. The statement, posted on September 29, 2025, was made in response to a discussion involving crypto commentators Laura Shin and Calily Liu, challenging any perception of an "easy" path to Ethereum's current standing.

"@laurashin @calilyliu No, I wouldn't say it was easy for ethereum to game ~$500 billion in app capital, representing a ~75% market share among major chains," the user stated in the tweet.

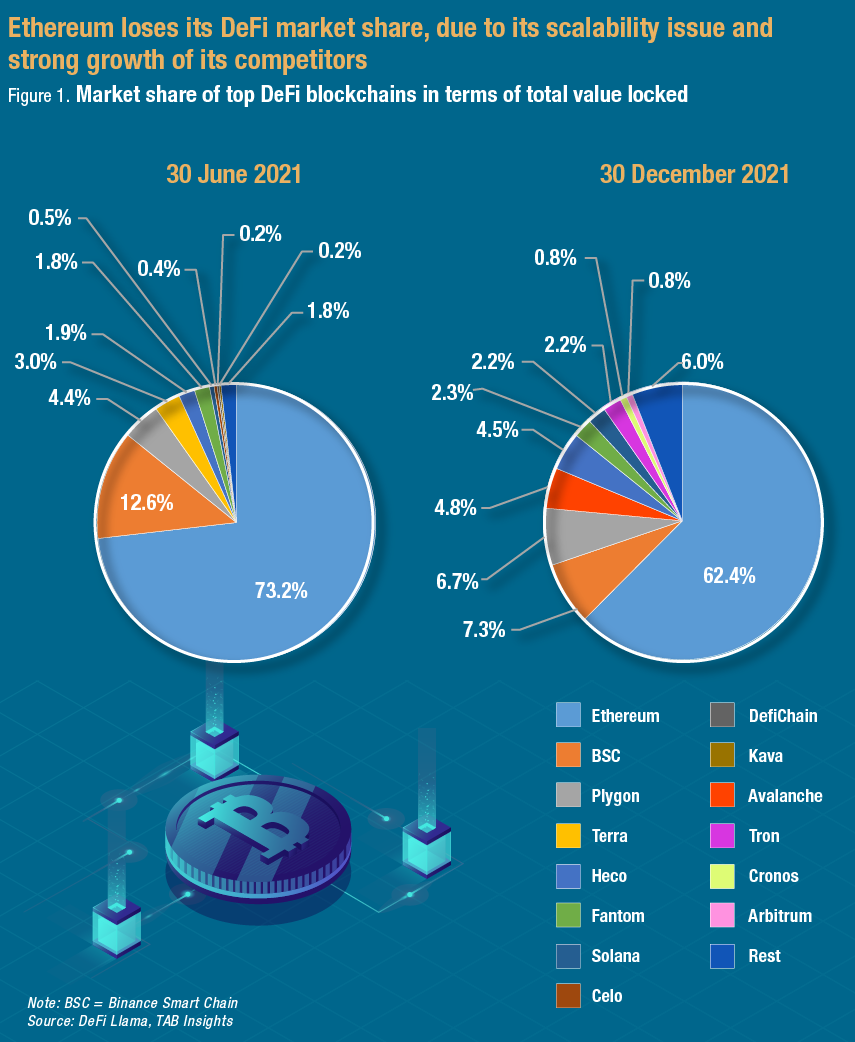

This claim underscores Ethereum's significant influence in the decentralized application (dApp) ecosystem, a metric often gauged by Total Value Locked (TVL) within its smart contracts. While the tweet highlights a substantial figure, historical data from platforms like DefiLlama indicate Ethereum's TVL peaked at around $172 billion in November 2021. Current figures place Ethereum's TVL at approximately $58 billion, representing about 60% of the total value locked across all chains.

Ethereum's sustained leadership in the DeFi and dApp sectors is largely attributed to its early market entry, robust infrastructure, and a vast, active developer community. These factors have fostered a rich ecosystem of decentralized finance protocols, NFTs, and other applications, solidifying its position as a foundational blockchain for innovation.

Despite its enduring dominance, Ethereum faces increasing competition from alternative Layer 1 blockchains such as BNB Chain, Solana, and Arbitrum. These networks aim to offer enhanced scalability and lower transaction costs, continually vying for a larger share of the expanding decentralized economy. The ongoing evolution of the blockchain landscape ensures that discussions around market share and capital distribution remain dynamic and central to the industry's discourse.