Life360 Stock Soars 130% Year-to-Date, Market Cap Nears Half of Snap's Valuation

Life360, the family safety and location technology company, has seen its stock surge by approximately 130% year-to-date, prompting social media commentary highlighting its significant growth relative to its market valuation. As of early November 2025, the company's market capitalization stands at approximately $7.6 billion, positioning it as a notable player in the technology sector.

Alex Kehr, a social media personality, underscored the company's performance, stating in a recent tweet, "> life360 is so underhyped. its market cap is half of snapchat’s and the stock is up 130% this year." This observation draws attention to Life360's impressive stock appreciation and its valuation compared to tech giants like Snap Inc., which maintains a market cap of around $13-14 billion.

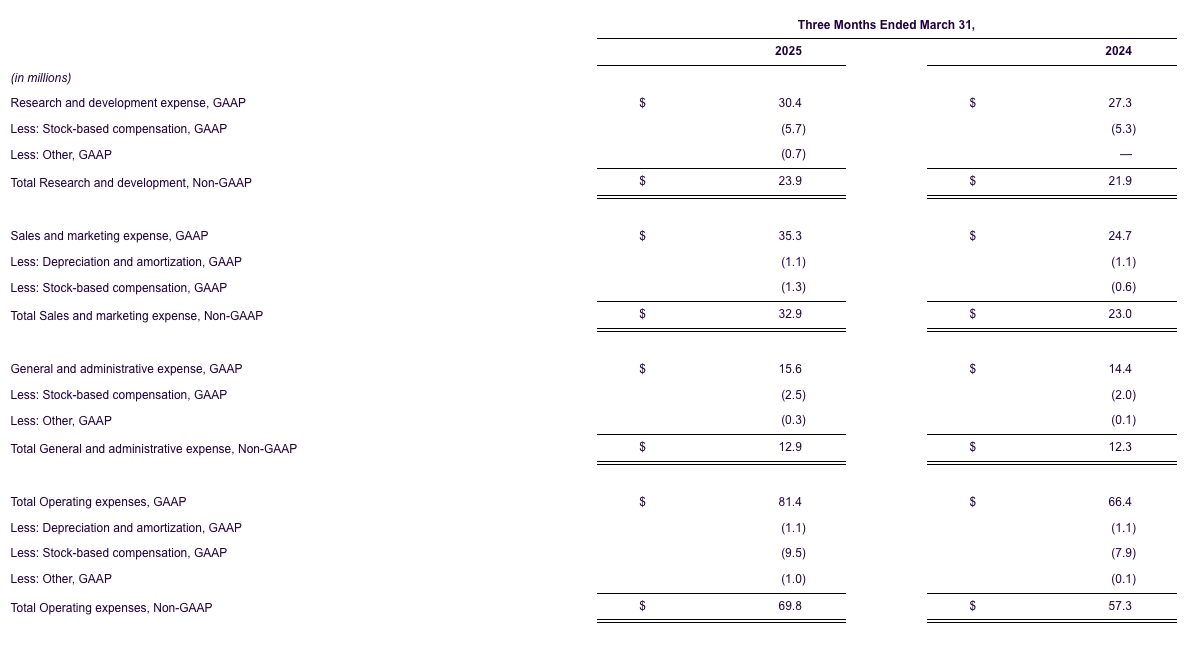

Life360 operates a freemium mobile application offering location coordination, driving safety, digital safety, and emergency assistance services globally. The company monetizes its platform through premium subscriptions, the sale of Tile hardware tracking devices, and advertising. Its business model has proven resilient, with record-breaking Q1 2025 financial results showing a 32% year-over-year increase in total revenue to $103.6 million and a 38% rise in Annualized Monthly Revenue to $393.0 million.

Despite a cautious consumer spending environment, Life360 achieved a net income of $4.4 million in Q1 2025, marking its tenth consecutive quarter of positive Adjusted EBITDA. Analysts have noted the company's strong growth trajectory, with UBS raising its price target from $57 to $71 in June, citing the absence of significant updates from Apple’s "Find My" platform as a positive factor. Life360's focus on family safety and its large user base of over 83 million active users contribute to its competitive edge against rivals.

The company's strategic growth is further supported by its acquisition of Tile in 2021, expanding its offerings to include item tracking. This integration enhances its ecosystem of safety and location services, reinforcing its market position. Life360 remains confident in its ability to maintain positive financial performance throughout 2025, driven by strong subscription growth and operational discipline.