Mobile Wallets: Widespread Adoption Meets Persistent Reliability Concerns, Driving Innovation

Global mobile wallet adoption continues its rapid ascent, with transaction values projected to reach $17 trillion by 2029. Despite this explosive growth and increasing consumer reliance, a sentiment of inconsistent reliability, as highlighted by tech commentator Josh Ong, underscores ongoing user experience challenges within the burgeoning digital payment landscape.

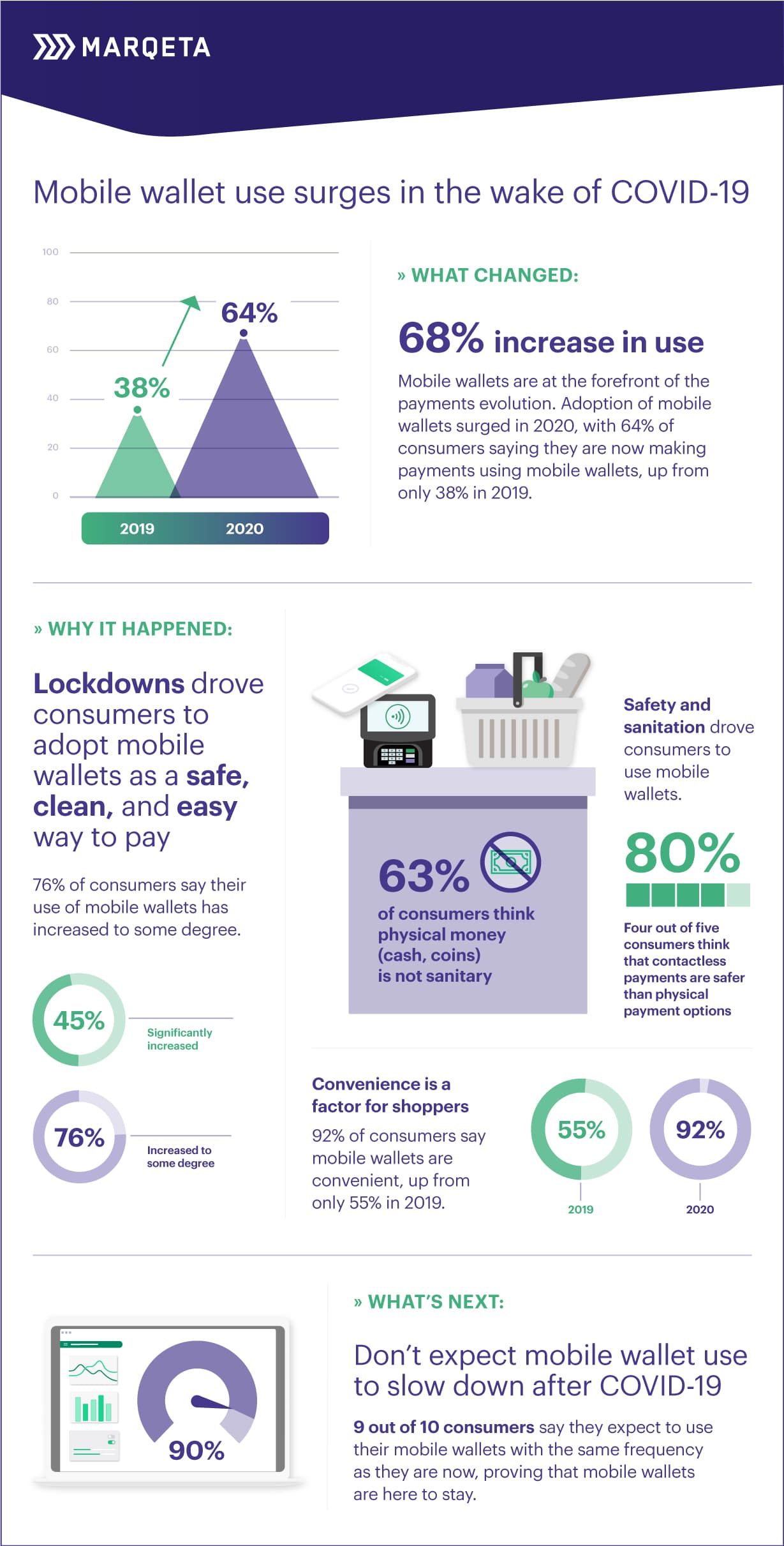

Mobile wallets, encompassing services like Apple Pay, Google Pay, and PayPal, have become a cornerstone of modern commerce, with over 3.4 billion users worldwide. In 2023, digital wallets accounted for 30% of global point-of-sale transactions and 50% of online purchases, demonstrating their significant penetration. Projections indicate that by 2026, over 5 billion consumers will utilize digital wallets.

However, the user experience is not always seamless. Josh Ong, in a recent tweet, expressed a common frustration, stating, "> The best thing about mobile wallets is 60% of the time, they work every time. Who

’s solving this?" This anecdotal observation reflects broader issues identified in recent studies, including device incompatibility, limited currency support, and technical difficulties often stemming from poor internet connectivity.

A 2025 study on mobile payment applications identified key problems including technical and operational limitations, accessibility barriers, and social issues related to security and connection. Users frequently encounter app crashes, transaction failures, and concerns over data privacy and fraudulent activities, such as phishing and identity theft. These issues can erode user confidence despite the inherent security features like encryption and tokenization.

The industry is actively addressing these challenges through various innovations. Enhanced security measures, including biometric authentication and AI-driven fraud detection, are becoming standard. Companies are also focusing on improving cross-platform compatibility, simplifying payment integrations, and ensuring regulatory compliance to foster a more reliable environment. The development of "super apps" and integrated financial services aims to create a more cohesive and frictionless user journey.

Despite the hurdles, the convenience and efficiency offered by mobile wallets continue to drive their widespread adoption. The shift away from cash, coupled with government initiatives promoting digital payments and the increasing prevalence of smartphones, ensures that mobile wallets will remain a dominant force in the global financial ecosystem. Continued innovation and a focus on resolving user pain points will be crucial for achieving universal trust and consistent functionality.